A home equity loan, also referred to in the form of an equity loan installment loan for home equity, or a second mortgage, is a kind of debt that is a consumer. Home equity loans permit homeowners to take out loans against the equity of their homes. The loan amount is determined by the gap between the property's actual market value and the remaining mortgage debt. Home equity loans are usually fixed-rate, while the most common alternative home equity lines of credit (HELOCs) typically are variable in rate.

The Way a Home Equity Loan Works

An equity loan for a home is similar to a mortgage, which is why it has the name "second mortgage. The equity of the home acts as collateral to the lending institution. The amount a homeowner can borrow depends on a value-to-loan proportion of between 80 percent to 90 percent of the home's appraised value. Of course, how much the mortgage, as well as the interest rate, is charged will also be contingent on the credit score of the applicant and the history of their payments.

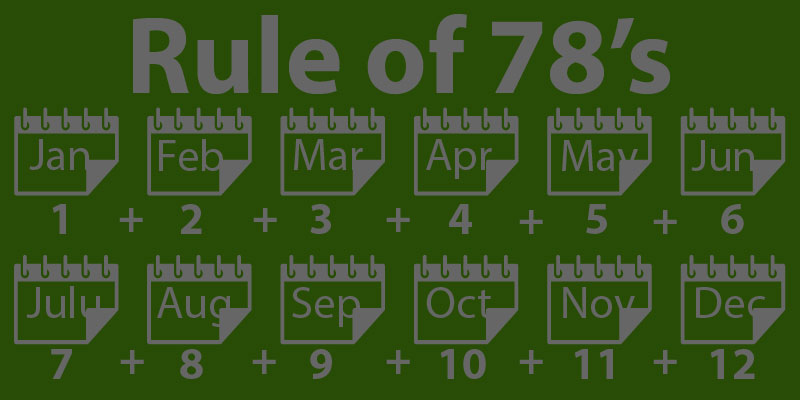

Traditional home equity loans are characterized by fixed repayment terms, as do conventional mortgages. The borrower must make regular, fixed payments that cover both interest and principal. Like any mortgage, when the loan isn't fully paid back, the house can be sold to repay the remainder of the amount owed.

Home equity loans may be a great option to turn the equity you've built within your house into money, specifically if you use the cash for home improvements that improve the worth of the house. But remember that you put your house on the line by taking out a loan. If property prices decrease, you may end up with more debt than the value of your home.

If you're planning to move and you are planning to move, you could lose money from selling your home or be unable to relocate. If you're taking out a loan to repay your credit card bills, you should resist the urge to rack up your credit card balances over and over. Before you do anything that could risk your home, take a look at all your choices.

Pros and Cons

These loans for home equity are suitable for those who know the amount they require to complete a project because the money is distributed in one lump amount. In addition, they're an excellent alternative for those looking to make home improvements since the interest they pay can be tax-deductible if the funds are used to renovate.

In contrast, if you utilize the funds from your home equity loan for any purpose other than major home improvement, for example, repaying student loan debts and consolidating credit card debt, the mortgage interest is not tax-deductible anymore in the context of tax law. Another advantage of home equity loans is that they offer low-interest rates, typically lower than cash-out refinances and personal loans. Compare rates from lenders to get the most competitive rate available.

But, if you require urgent cash, the home equity loan might not be the best way to choose. It may take longer to receive money from a home equity loan than from an individual loan. In addition, you could be liable for high closing charges.

Special Considerations

Home equity loans gained popularity following their introduction under the Tax Reform Act of 1986 as they offered a means to consumers to circumvent one of its principal provisions, which was the elimination of deductions for the cost of interest on the majority of consumer purchases. The legislation left an exception: interest on the service of residential-based debt.

However, the Tax Cuts and Jobs Act of 2017 halted the deduction of interest on HELOCs and home equity loans until 2026 unless, in the words of the IRS, "they are used to build, buy or significantly improve the property of the taxpayer which is the collateral for this loan." Interest paid on a loan to use home equity to consolidate debts or to pay for a child's college costs; for instance, it is not tax-deductible.

Before taking out an equity loan for your home, compare the terms and rates. If you are considering an offer from the local credit union instead of focusing on the big banks. Credit unions may offer higher interest rates and more personal account services. If you're willing to work with a slower processing time.