Introduction

You should be saving money with your 401(k) plan. Despite your best efforts, life sometimes gets in the way of your 401(k) contributions. It might be several dollars in emergency room fees or extensive damage to your home from a natural disaster like a fire or tornado. If you don't have enough money, you might look into other quick sources like retirement accounts. The choice to withdraw funds from a 401(k) plan is not to be taken lightly, but it may be warranted in certain circumstances.

Factors to Consider Before Cashing Out a 401(k)

If you've recently lost your job and were contributing to a 401(k) at your former employer, you might be able to take a distribution. Workers can take their retirement funds early if they so want. Before making any withdrawals, you should carefully consider the timing, amount, and purpose of any withdrawals from your investment account. If you're thinking of withdrawing money from your 401(k), here are some things to keep in mind:

Calculate What You Will Pocket

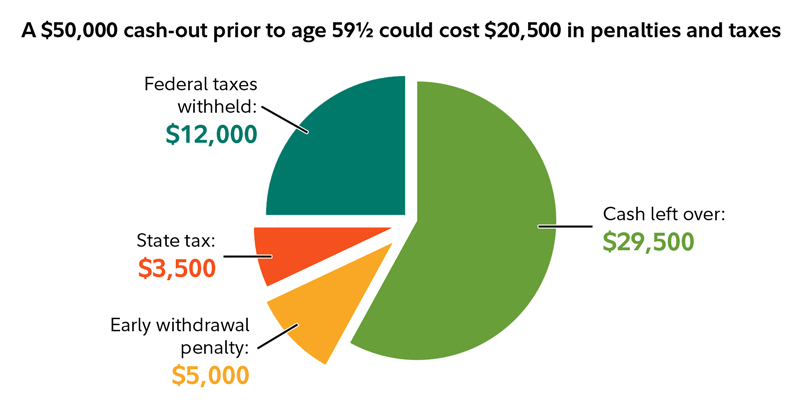

Withdrawing from your retirement savings will severely reduce your savings. Your taxable income will increase by the amount of the withdrawal. You may need to remove more money than you originally planned because "the taxes and penalty alone may significantly reduce the money you accessed." The IRS will not enforce the penalty if you qualify for a hardship exemption, such as becoming incapacitated or receiving disaster relief funding. Hardship withdrawals are an option with some programs. You can get all the information you need about your plan by contacting the plan's administrator or the human resources department.

Consider if the Funds Are Necessary

Consider whether or not you need the cash to deal with unforeseen expenses, and if so, give that some thought. According to Spencer Pringle, a financial emergency is a scenario that, if not dealt with effectively, might severely affect your capacity to live in your home, your health, or your ability to pay for needed products. Food, transportation, utilities, and the repayment of any overdue loans are all examples of necessities.

Look Into Other Ways to Access Cash

Expenses can add up quickly, so figuring out how much money you'll need to get by is important. It's possible that you won't need your entire 401(k) emergency fund, even in the worst-case scenario, Pringle explains. If an unexpected expense arises, you may usually withdraw only the amount you need and reinvest the rest. Consider alternative means of acquiring the necessary finances. You may pay for it by drawing from an emergency fund, getting a loan, refinancing your home, or reducing your regular spending.

Think About Continuing to Invest

It's possible that you can leave your 401(k) with your former employer rather than take the money with you. Other options exist for safeguarding retirement savings if you choose not to leave them with your former employer.

Consider the Drawbacks Versus Benefits of Cashing Out a 401(k)

If you need money fast, you can get it by cashing out your 401(k). An early 401(k) withdrawal could help you avoid debt if you lose your job and utilize the money to meet living expenses until you start new employment. You can resume retirement planning and saving once your income has stabilized again. However, there may be serious long-term repercussions for cashing out. If you withdraw the money, you will forego future interest and gains on your 401(k).

Talk to an Advisor

It's not always easy to figure out what's best for your money when choosing. Weighing the importance of meeting urgent demands against the feasibility of accomplishing long-term ambitions is essential. You may increase your income by engaging in some supplementary activity. It's possible that you can use savings or reduce spending. Consult an accountant or financial planner to weigh your options and make a choice that serves your short- and long-term goals.

Conclusion

You will always lose money when you take money out of your retirement fund. Withdrawing from your 401(k) too soon means giving up the potential growth of a larger sum over time. If the funds do not qualify as a hardship or exception under IRS guidelines, you will not have to repay them, but you will be required to pay income taxes on them plus a 10% penalty. A loan taken out against your 401(k) must be repaid. If the loan is repaid on time, you won't have to worry about losing too much of your retirement account's growth.