Introduction

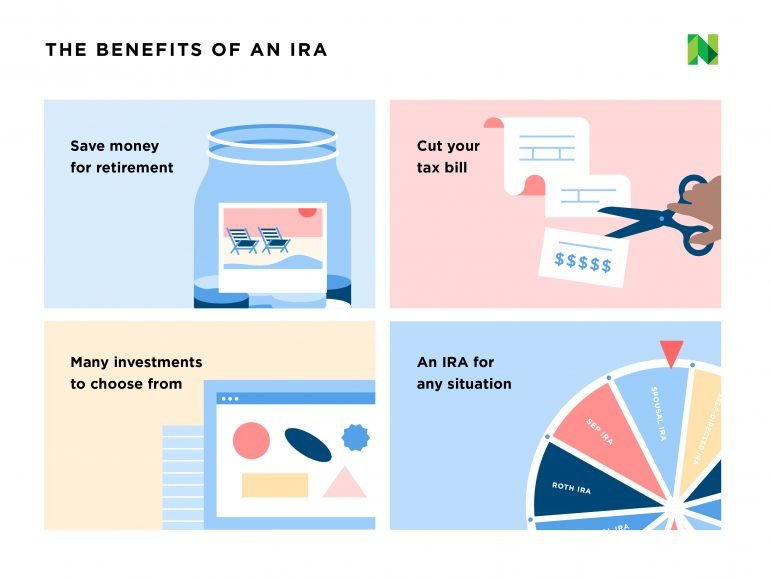

Individual retirement accounts (IRAs) and 401(k)s are two examples of tax-advantaged savings vehicles that are worth looking into if you are saving for retirement (k). Anyone who can document earned income can open a traditional Individual Retirement Account (IRA) and make contributions. This is a great retirement savings option for workers who do not have access to a 401(k) through their employer. Establishing one of these accounts can increase your retirement savings and reduce your tax liability. There are many types of accounts, and understanding how each work is crucial due to their many tax advantages. With an Individual Retirement Account (IRA), a person can invest in almost anything and enjoy favourable tax treatment (IRA). This is why an IRA is a great way to put money down for the future.

Traditional IRAs: Tax Savings Upfront

The maximum annual contribution to all your IRAs (including traditional and Roth) in 2021 and 2022 is $6,000, or $7,000 if you are 50 or older. One, you can deduct your contributions from your taxable income, leaving you to pay taxes on the remainder of your income. By contributing the maximum to their IRA (currently $6,000), a 35-year-old with an annual salary of $75,000 would see their taxable income drop to $69,000. This would be the case if they put in the maximum amount of $6,000.

And if the deduction causes them to enter a lower tax bracket, their savings will be even greater. Employees with high earnings who are also protected by a workplace retirement plan may discover that they cannot take advantage of the maximum permissible tax deduction for contributions to their retirement plan. Income is adjusted using a formula to calculate the maximum amount you are eligible to receive (MAGI).

Roth IRAs: Tax Savings in the Future

With a Roth IRA, you put away cash that has already been taxed rather than pre-tax dollars like you would with a traditional IRA. In this way, the Roth IRA might serve as an option for the more common traditional IRA. The distinguishing feature of a Roth IRA is the option to withdraw investment gains tax-free once retirement age is reached (IRA). Eligibility for and the maximum allowable contribution to a Roth IRA are both based on your income level, which is subject to certain constraints. As with traditional IRAs, these include income requirements and caps.

How Does an IRA Affect Taxes

It is possible to reduce the amount of taxable income by making contributions to a traditional Individual Retirement Account (IRA) with pre-tax dollars. When you reach age 59 1/2, you will be subject to income tax on the amount distributed from your investments, regardless of how long they have been growing tax-free. Since Roth IRA contributions are made with after-tax dollars, the money you withdraw from the account is also not subject to taxation. This is what separates Roth IRAs from standard IRAs.

IRA Contribution Limits

The Internal Revenue Service (IRS) sets annual limits on how much money you can put into an individual retirement account (IRA), regardless of whether you choose a traditional or Roth IRA (IRA). All IRAs are subject to these limits. The IRA contribution limit for both 2021 and 2022 is $6,000. Those who are 50 or older can make a $1,000 catch-up donation. Individual retirement accounts (IRAs) have the same aggregate contribution limits regardless of the number of accounts you have (IRAs).

How to Reduce Your Taxes with IRA Contributions

If you meet the age and other conditions, you can put away either $6,000 or $7,000 a year into a regular or Roth IRA. With a traditional IRA, you can often deduct your contribution from your taxable income the same year you make it. You won't have to pay income taxes on the growth of your investments until you begin withdrawing money from your account, which can be done without penalty until age 59 and a half. You may be able to lower your taxable income by making contributions to a typical Individual Retirement Account (IRA).

If your marginal tax rate is 32%, an IRA contribution of $6,000 will reduce your taxable income by about $1,000. By putting money into an IRA before April 15th, you can reduce the amount of last year's income that will be taxed. Other IRAs, such as SEP IRA, may also accept donations at the last minute if you have access to them. Self-employed people and business owners benefit greatly from SEP IRAs because their contribution limits are nearly ten times higher than traditional IRAs. You can fund a standard IRA and a SEP IRA with your salary. You can always ask for an extension if you need additional time to save money for your SEP IRA.

Conclusion

A great way to reduce your overall tax liability is to use an Individual Retirement Account (IRA). However, keep in mind that there are constraints on the number of accounts you can maintain and the total amount of money you can deposit into each account. To reduce the amount of your income subject to taxation, you may want to investigate other possibilities, such as HSAs and FSAs. To avoid making costly mistakes with your money, you must get the advice of a financial professional before taking any action.

With an IRA, you can do both, so don't feel you have to choose (IRA). You can put money into both of them without breaking any rules, but remember that the limits on your contributions are cumulative, not per account. If you can't say for sure how much money you'll be making or what your tax bracket will be when you retire, it makes sense to put money into both types of accounts.